As several of our team members travelled home from the annual EOA conference on the afternoon of Wednesday 26th November (carpooling in an EV of course!), we found ourselves engrossed in the Chancellor’s Budget announcement and the reaction coverage over the radio.

After spending two days networking with fellow Employee Owned companies, sharing insight, experience and ideas in such an overwhelmingly collaborative and vibrant setting, it was certainly a contrast to hear the raucous and divisive sounds of parliament taking jabs at one-another, in what the opposition described as a “smorgasbord of misery” – which we decided was the phrase of the day!

Below is an overview of how the 2025 Autumn Budget affects the self build and renovation community...

- Planning Permission – Unblocking the bottleneck

- Energy bills – Levies lifted

- Boiler Upgrade Scheme - Extended and expanded

- Warm Homes Plan – Watch this space!

- ‘Mansion Tax’ – For homes valued over £2m

- Electric Vehicles – New mileage-based tax

Planning Permission – Unblocking the bottleneck

One of the clearest benefits for home-improvers lies in reforms to planning. The government pledged £48 million to recruit an extra 350 planners in England, through an expanded graduate scheme and a new “Planning Careers Hub.”

The government is investing to recruit hundreds more planners and strengthen regulators, aiming to fast-track housing and infrastructure decisions. The goal is to support growth by “backing builders not blockers” with what the government describes as the “biggest planning reforms in a generation”.

Year-on-year, our survey of self builders shows that planning is the largest hurdle, so this is a welcome step to unblock the system. Whilst it remains to be seen whether this is significant enough, the reforms are expected to speed up the planning system. For homeowners stuck waiting for approvals, this could make a tangible difference.

Energy bills – Levies lifted

The Energy Company Obligation (ECO4) scheme will end on 31 March 2026. ECO is an obligation placed on energy companies to deliver energy efficiency measures to domestic premises.

Instead, some of the funding earmarked for ECO will now go into removing levies from energy bills. This is expected to lower bills for millions of households by £150 a year, the chancellor said.

While the reduction in bills will no doubt be welcome news, we are concerned that there is a potential reduction in access to subsidised insulation materials – which is important in tackling our aging and leaky housing stock.

Boiler Upgrade Scheme - Extended and expanded

This established Boiler Upgrade Scheme (BUS) currently offers grants of £7,500 off the cost of installing an air source or ground source heat pump, which can keep homes warm during the winter.

The Budget expands this to include a £2,500 discount off the cost of installing air-to-air heat pumps providing heat in winter and keeping you cool in summer, and heat batteries, storing energy for when you need it most.

This is the first time air-conditioning units have been eligible for government funding, meaning residents will benefit from cool homes during a long, hot summer, without burning harmful fossil fuels. This comes as 2025 is a record-breaking year for heat pumps, with September being the best month for applications on record, as the British public show unprecedented demand for clean heating.

Whilst these solutions are a fantastic way to move away from fossil-fuels, effective integration is key to keep your home comfortable and to genuinely reduce your heating bills. Our brand new Retrofit Zone exhibit helps you understand how to plan a ‘whole home’ and 'fabric first' approach, to make the most of this transition. Our Renovation House sponsored by Good Energy, is also a fantastic resource which will help you understand renewable technology integration.

We always recommend using MCS Certified installers to ensure they are fully trained and vetted.

Warm Homes Plan – Watch this space!

A £13.2 billion investment the new Warm Homes Plan has been confirmed - including the Boiler Upgrade Scheme grants mentioned above - but the budget announcement didn’t include the much anticipated further specifics expected by many in the industry.

The financial boost for the Warm Homes Plan which will create warmer, energy efficient homes and improve the health and wellbeing of residents – but it’s crucial that homeowners seek out professionals with the necessary understanding to get this right.

A recent report from the National Audit Office (NAO) identified that 98% of homes with external wall insulation (EWI) installed under the government’s ECO scheme require work to correct major issues that will cause problems such as damp and mould. For us, this drives home the importance of using appropriate breathable materials for solid wall properties, and how crucial it is to close the skills gap in the workforce, to deliver retrofit solutions effectively.

Our brand new Retrofit Zone, is the perfect place to begin your educational journey, and to build connections to make your project a success.

‘Mansion Tax’ – For homes valued over £2m

The Budget introduces a new “high-value property levy” for homes worth over £2 million. From 2028, owners of such properties will pay an extra annual surcharge of at least £2,500 alongside standard council tax.

This adds a layer of cost for those targeting the top end of the market. The annual charge will come on top of existing council tax, and will increase depending on the price of a property - with four separate bands.

- Properties valued from £2m to £2.5m will pay £2,500

- Properties valued from £2.5m to £3.5m will pay £3,500

- Properties valued from £3.5m to £5m will pay £5,000

- Properties valued at more than £5m will pay £7,500

While known as a mansion tax, it may also capture homes in expensive areas, and will be levied on about 100,000 properties, primarily in London and south east England. The charge is imposed on top of existing council tax, but the money will go to the Treasury rather than the local authority. Announcing the change, the chancellor said she was taking "further steps to deal with a longstanding source of wealth inequality in our country".

Some of the reaction to this however, has raised the issue with people potentially being ‘asset rich, cash poor’ and not being able to afford the payments.

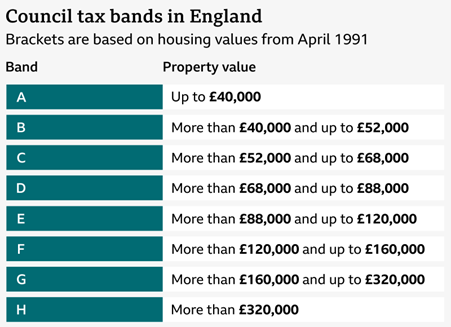

The move will require the valuation of homes in the top council tax bands - F, G and H - for the first time since 1991. You can check your council tax band here if you are in England and Wales, external, Scotland, external, and Northern Ireland, external.

Electric Vehicles – New mileage-based tax

Although not directly linked to Self Build & Renovation, we know that more and more of our visitors are switching to EVs, and integrating charging points in their homes.

Electric vehicle and hybrid car drivers will be taxed for using the road from 2028. Under the plan, fully electric cars will be charged 3p per mile, while plug-in hybrids will pay 1.5p per mile, with the rate rising each year in line with inflation.

Because this is separate from the existing annual vehicle-licence tax (VED), EV owners will now have both a per-mile component and the regular VED obligation.

For many drivers, even after the new per-mile tax, EVs remain more cost-effective overall than petrol cars - thanks to lower fuel (electricity), lower maintenance, and other savings. Calculating the number of miles that drivers cover is difficult but for a “typical” driver doing around 8,500 miles a year, that works out to about £255 per year - a cost many reports characterise as roughly half the per-mile running tax cost for an equivalent petrol or diesel car.

At the same time, the Budget includes measures that help to soften the blow for EV drivers and encourage adoption:

- Further investment in EV infrastructure and charging-point rollout — aiming to support broader availability of charging for households without off-street parking.

- Higher thresholds for “expensive-car” supplements for EVs: from April 2026, the threshold beyond which additional road tax applies rises — meaning many mid-priced EVs may avoid extra charges.

Hopefully you find this overview useful. We’re sure we won’t have covered every angle, or thought of every impact the 2025 Budget may have on your individual projects and the wider self build and renovation industry, so please get in touch if you have anything to add.